Forget software, this is global expansion with a human touch

Global hiring, HR, payroll, and on-hand global expertise from a single, dedicated point of contact. Gibson Watts Global helps businesses to establish and scale their teams and enter new markets without the need of a foreign entity. Unlike software-driven competitors on the market, we take pride in offering a people-led, human service.

Become a global business in one, dos, trois!

Plan

Our knowledgeable global teams work as a human extension to your business. We work closely with our clients to help them identify new opportunities in global markets, plan an effective and streamlined global expansion, and have all of the leading in-country knowledge when expanding.

Expand

Building a global business is easy when you expand with Gibson Watts Global. We not only expedite the expansion process, but ensure the very best experience for your global workforce. We work hard to make sure employee satisfaction and retention is at the very heart of our your expansion.

Grow

We believe in limitless businesses. That’s why, following a successful international expansion, we love to ask ‘where next’? By recognizing global opportunities and maximizing existing ones, we are continuously looking for ways to help our clients grow, explore new markets, and attract / retain the best employees.

So, which global service is right for you?

We’re proud to support businesses expanding in over 120 countries globally, offering a wide variety of different global expansion services. Working as an extension of our clients’ teams, we help to identify international opportunities, where they are, and the best way to achieve them.

Our robust PEO / EOR covers everything from global HR, payroll, compliance, in-country support, immigration, visas, and more. This tailored service is designed to work closely with businesses until they are ready to establish a permanent entity overseas.

Because humans are more than just resources

Our personal approach ensures that we put the satisfaction of your employees first. We enable expanding organizations to retain the best of their global workforces, allowing them to facilitate their business’s steady growth when entering new markets.

Wherever you’re expanding your horizons, Gibson Watts Global provides a dedicated advisor and point-of-contact for your entire journey. We help you and your employees to understand everything from the relevant legislation to cultural information for your chosen destinations.

By keeping your global employees happy, you have everything that you need to ensure a successful global expansion for your business.

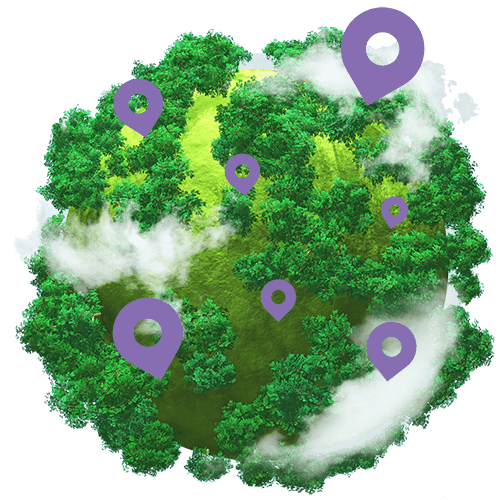

We plant 25 trees

for each new hire!

Doing our little bit for the planet

For every new hire with Gibson Watts Global, we will plant 25 trees. The trees are planted via our partner Ecologi. Ecologi is a climate-positive environmental organisation that facilitates the funding of carbon offset & tree-planting projects around the globe. Check out our own personal forest that we’ve already been able to create with the help of our existing clients

Don't just take our word for it!

Rockin’ all over the world

We proudly support our clients in over 120 countries globally, providing unparalleled support and guidance across all corners of the world. Your global PEO advisor will assist you with every aspect of your global expansion, provide all the necessary support and information for your global employees, and assist you with strategic decision-making for your ongoing growth.